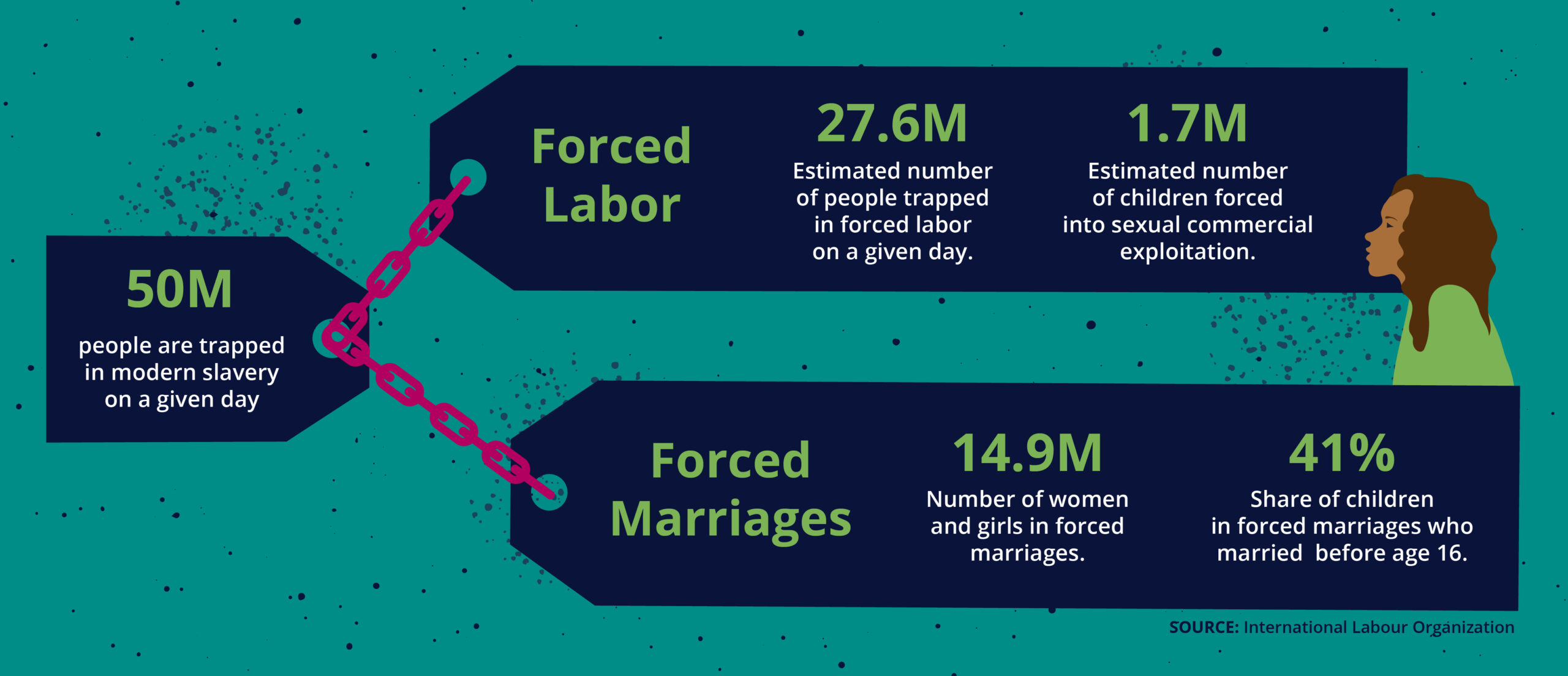

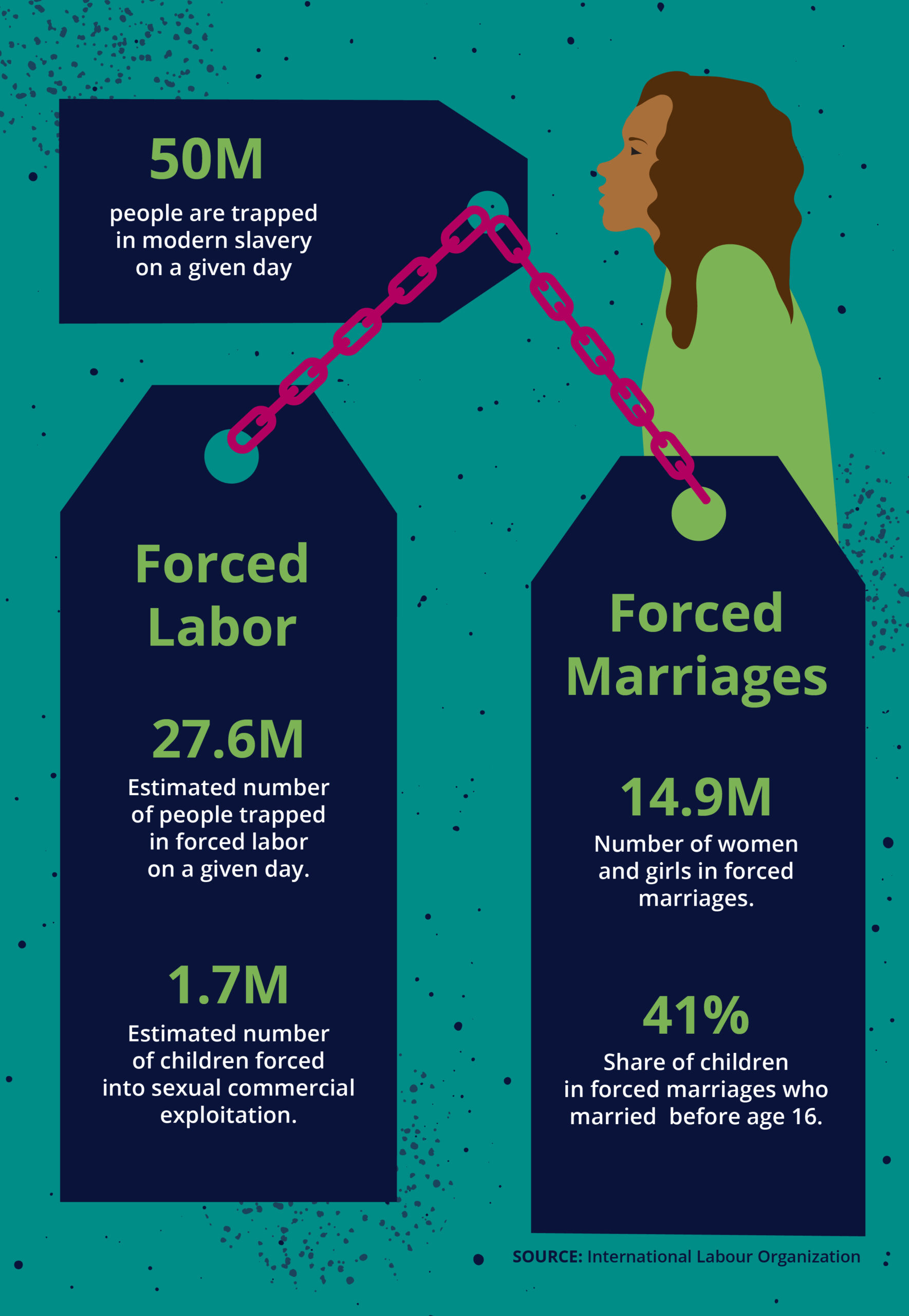

January is National Slavery and Human Trafficking Prevention Month and January 11 is National Human Trafficking Awareness Day. With over 50 million people affected worldwide - a 10 million increase over five years - this form of “modern slavery” needs everyone to join to fight against human trafficking. For financial institutions, Human Trafficking Awareness Day and Month are critical reminders of how anti-money laundering (AML) solutions can combat this heinous crime.

The Many Faces of Human Trafficking Victims

It’s easy to hear the term “human trafficking” and think of adults or even children forced into the sex trade, but human trafficking is so much more than that. Everyday people can find themselves ensnared by a trafficking ring because of scams, coercion, or even brute force. This includes forced labor arrangements, one of the most common human trafficking typologies.

Children are not immune from the forced labor trap. A major automobile plant in Alabama was accused of using illegal child labor last year. The youngest victim was 12 years old while the oldest was 15 years.

Criminals exploit economic uncertainty to recruit people into trafficking schemes with alluring employment opportunities. A man in Taiwan shared his story of being lured to Cambodia with the promise of a good-paying job in telesales. When he arrived in Cambodia, however, his passport was seized and he was told he was not allowed to leave the compound where he was staying. Instead of a telesales job, he found himself working in a “fraud factory” where he scammed other online victims.

“Pig butchering” is another type of scam used to recruit human trafficking victims in Asia. Scammers build trust with their victims before encouraging them to download an investment app that steals all of their savings. The name of the scam is a reference to fattening up a pig before killing it for food.

Desperation is Human Traffickers’ Greatest Recruitment Tactic

Increasingly uncertain economic situations make people highly vulnerable to trafficking recruitment tactics. In the face of a looming recession, a job loss, or a mountain of debt, some people become desperate enough to respond to shady offers. Others may trust the wrong people in their effort to become famous.

All of these scenarios have one thing in common: victims are eager to escape their current situation. Desperate people make easy prey.

Recent political events give traffickers even more opportunities. In China, the government’s strict COVID-19 lockdowns sparked widespread protests. Earlier this year, hundreds of shoppers fled an Ikea when it was announced that the store was going on lockdown. Meanwhile in Russia, many young men are fleeing the country to avoid being conscripted into fighting the war against Ukraine. When people are desperate to leave their current situation, they may turn to human traffickers to help them cross borders. However, only the traffickers know for sure if the victim will be better off in the end.

How Banks Can Protect People on Human Trafficking Awareness Day and Beyond

Human Trafficking Awareness Day and Month may only be recognized once a year, but for financial institutions, stopping this crime should be a year-long effort. If banks link their human trafficking awareness efforts with their investment in AML policies, training, and monitoring tools they’ll be more effective in stopping human trafficking. Here’s how they can do just that.

Monitor customers’ transactional geography

Banks can use technology to view a timeline of their customers’ transactions and where they take place. By analyzing these transactions, they can determine if a customer’s behavior is usual or if it raises red flags for human trafficking. For example, if a customer who typically only has a few transactions in their city suddenly has a lot of transactions moving across the country, it may be worth further investigation.

Banks can look deeper into a customer’s spending to spot suspicious activities. Numerous fast food purchases, motel or hostel stays, or purchases for unusual items for the customer (e.g., diapers, baby formula) may be signs that a trafficking ring is at work.

Use cross-referencing to know your customers

Financial institutions can also look into how a customer is behaving compared to how they were expected to behave at onboarding. Does their recent behavior match their expected behavior from their KYC/CDD review? For example, if the customer is a local bakery owner making multiple cross-country trips, that should raise suspicion. The unusual nature of these transactions indicates that something is wrong.

Review databases of known trafficking perpetrators

Anti-money laundering solutions should not only screen for watchlist names, but also for human trafficking awareness. There are many databases of human trafficking perpetrators and victims. Bank staff should review these third-party databases for connections between their customers and known human trafficking perpetrators or victims. Third-party providers maintain lists of both traffickers and victims, and bank personnel should be trained to recognize relationships between them.

Educate staff on how to spot trafficking signs

Human trafficking is often a cash-based business. This means criminals will eventually have to visit a bank branch in person to make a deposit. That’s where bank personnel plays the most crucial role of all. Banks must train staff to be on the front lines of fighting human trafficking by spotting telltale signs. This includes watching the body language of people who walk into the branch even if they aren’t a customer. Bank staff are already required to be trained to spot elderly abuse. These same lessons should also be applied to stop human trafficking activities and spot important red flags.

Upgrade onboarding and ongoing monitoring

Criminals need a legitimate banking system for their illegal money. Banks need to be vigilant to prevent them from onboarding – and to root them out if their risk level suddenly changes. In the first part, banks must collect as much data about the person from a robust set of internal and external data sources. Doing so helps establish how the person is expected to behave and how you expect them to act to look for outlier activity.

In the second part, banks should shift away from periodic reviews and embrace perpetual Know Your Customer (pKYC) instead. Using pKYC, banks can identify when a person’s risk level has changed and immediately investigate instead of waiting months or even years. Monitoring how the customer’s behavior has altered over time is a key step in using anti-money laundering solutions to stop human trafficking.

The number of people trapped in modern-day slavery is growing. Dangerous global events and economic uncertainty work in human trafficking organizations’ favor. Joining this fight means more than posting hashtags like #wearblue on social media. It’s a time to listen to real stories of how human trafficking devastates human lives and takes multiple forms.

It’s important for banks to make an ongoing effort to combat human trafficking. Not just on a designated day or month, but every single day. By connecting their anti-money laundering efforts with the fight against human trafficking, they can make a real difference in raising human trafficking awareness.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…