Banks have a central role to play in the fight against money laundering. For banks to succeed, they need motivated people who are driven to see their employer implement strong, effective anti-money laundering (AML) compliance programs. Here’s how real change starts from the ground up - and what the milk market can teach us about making strong AML compliance a reality.

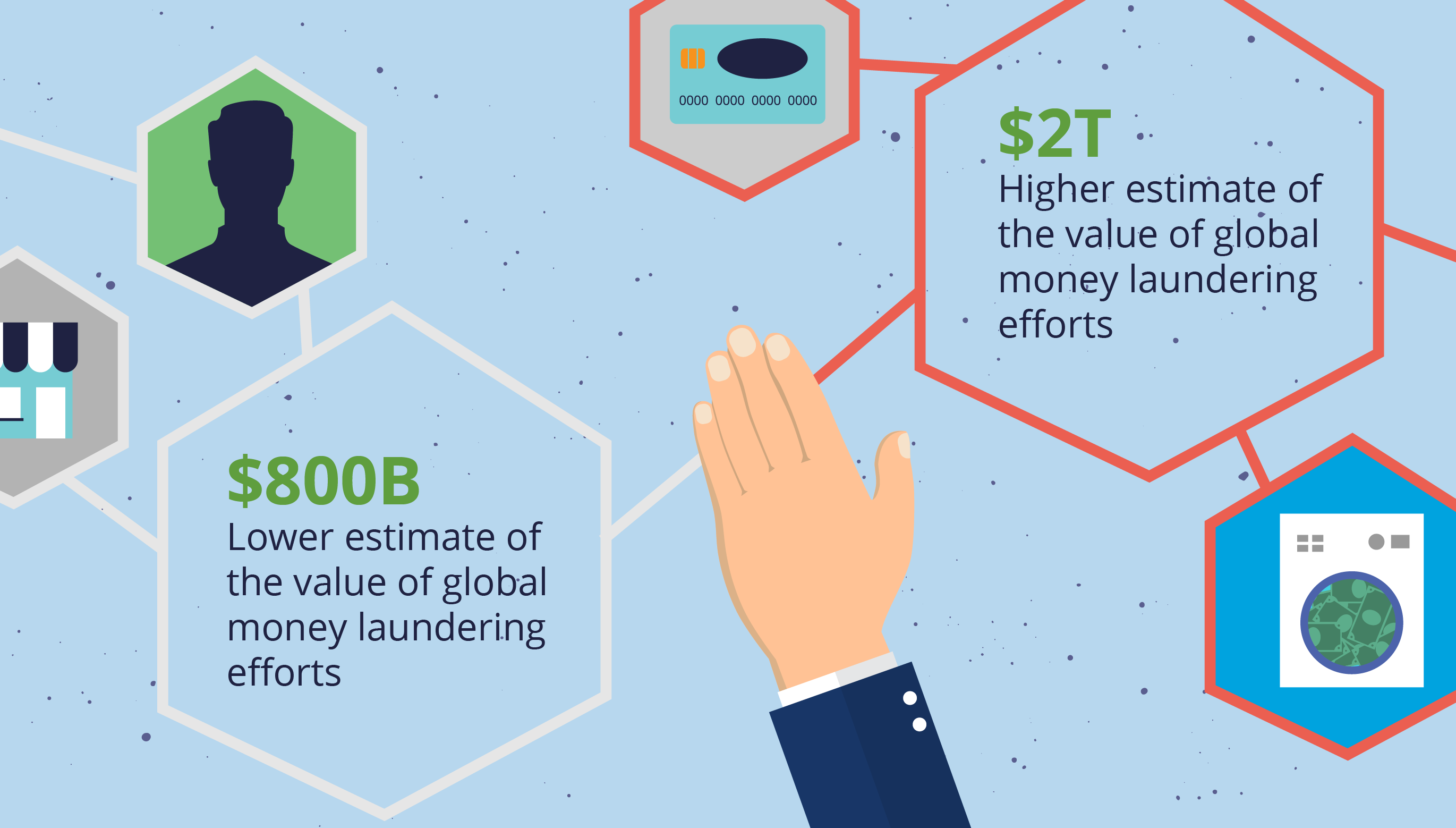

The United Nations’ Office on Drugs and Crime paints a stark picture of global AML compliance efforts. On the low end, the estimated value of money laundered in just one year is close to $800 billion. Higher estimates put the annual figure closer to $2 trillion, or roughly 5 percent of the global GDP. These criminal activities are interconnected and involve a range of well-known horrifying behaviors that take a devastating toll on people’s lives. Arms dealing, sex trafficking, corruption, and terrorism are just some of the atrocities funded by money launderers that result in deep human suffering.

Once dirty money enters the financial system, it is difficult to pinpoint its illicit source. That’s why financial institutions (FIs) need both strong transaction monitoring tools and dedicated people on the front lines to monitor suspicious patterns that will help bring money launderers to justice. But monitoring millions of transactions to sort legitimate activity from bad actors and money launderers can feel more difficult than searching for a needle in a haystack. After all, you can use a magnet to pull the needle from the hay. The task is more like using a magnet to pull out a single needle from a heap of scrap metal.

This essentially sums up the almost Herculean task that transaction monitoring often feels like for banks. And then there’s also the consequences to consider. Banks can face significant fines, damaged reputations, and employees and executives could even risk jail time if money laundering happens on their watch.

It doesn’t have to be this way. Real change is possible when dedicated people – including compliance officers, chief risk officers (CROs), and AML professionals – work to make sure their banks approach AML compliance differently. This might sound intimidating, but as former U.S. Customs agent Robert Mazur, whose efforts exposed Pablo Escobar’s criminal laundering operations, said in an interview, it’s these everyday individuals who can uncover dirty money patterns, which haven’t changed all that much since Escobar’s heyday. Mazur pointed out that he did it himself and that we can all be better at identifying suspicious money movement behaviors. Listen to his interview (sponsored by Feedzai and the ICA), here.

Changing habits of inertia in AML requires motivated individuals and bank leadership teams who are devoted to implementing organization-wide change. It also requires technology partners who bring experience and robust technology solutions to the AML fight. Here’s how each of these elements enables a more powerful and well-rounded AML compliance strategy.

A Strong AML Compliance Initiative Needs Strong Team Players

We’ve said it before, and we’ll say it again. Change begins with individuals who want to see things done differently. The phrase might sound like business buzzwords, but it’s important to remember that money laundering involves real people and incalculable human suffering. Real change begins when more everyday people say “enough” and work to make an impactful difference.

If you need a real-life example, consider the last time you went into the dairy section of your supermarket. Think of all the available milk options. Not that long ago, dairy milk from cows was the status quo with few, if any, alternatives available. What’s more, the milk taken from cows was done using appalling practices. Fast forward to today and most supermarkets can provide different milk options from non-dairy sources including almond, coconut, and oat. Dairy milk is still available, but there are more organic and cruelty-free options available.

It’s worth remembering that millennials are one of the most influential demographics in the workplace and want their companies to be equally focused on making a positive difference in the world. This means offering oat flat-white milk in your FinTech’s boardroom is both good for your reputation, your business, and can help recruit top talent.

The motivation to change the milk market can also be applied to the AML fight. Don’t be a dinosaur that bemoans the difficulty of the challenge. Take on the challenge and make a difference! Your kids will thank you and so will your employees and investors!

The lessons learned from the transformation of the milk market can be applied to the AML fight. Ultimately, it was the first decision to take a stand that led to recognizable change. AML reform and enhanced transaction monitoring begins with a few people insisting that the status quo is not good enough and convincing their leadership that their FI could lead the change against laundered money. The first step toward change and in fighting against money launders begins with YOU!

Change-Focused Leadership Strengthens the Fight Against Money Laundering

Changing the AML fight must also go up to the leadership level. Bank executives and leadership teams must make sure that their organization is doing everything it can do to stop money launderers.

Consider the Danske Bank scandal. Former CEO Thomas Borgen was forced to resign in disgrace over the role the Danish bank played in enabling roughly $224 billion in laundered money to transact through an acquired Estonian branch between 2007 and 2015. His home was raided by Danish authorities and prosecutors filed charges against him last year. But Danske Bank’s problems did not end with Borgen’s resignation. The bank remains under investigation by several law enforcement agencies and could face significant fines.

Reputations can take years to build but much less time to ruin, as the Danske Bank case highlights. This is why the entire team, from junior analysts to management, must work to make AML an organization-wide priority, not a check the box exercise. Leadership teams must demonstrate their AML commitment by implementing new training and education programs to help employees flag suspicious patterns.

The Right AML Compliance Technology Solutions

Of course, reviewing millions of transactions and determining which ones should be flagged as suspicious can be a tall order for human beings. Bad actors aren’t likely to tell the truth if they need a place to move their money. So if money launderers successfully open a bank account, bank employees will likely struggle to identify suspicious transactions.

Transaction monitoring solutions can use artificial intelligence (AI) to help banks find the needles in the scrap metal. These solutions are trained to review millions of transactions in seconds and highlight patterns that would otherwise go unnoticed by human beings. For example, AI-based tools can tell if an account linked to a customer who claims to own a bakery is behaving suspiciously. The tools can see that the “bakery” is selling an extraordinary volume of muffins and scones for its size, yet doesn’t have any other associated transaction activities like payroll, rent, or supplies. AI can alert analysts of these discrepancies and that this business is worthy of deeper investigation.

Motivated people need the most effective tools at their disposal if they want to be effective in their AML efforts. You could alienate your best talent if you don’t empower them with the best tech. Their jobs, after all, are to protect your business. Therefore, your priority should be to make their jobs easier and give them a transaction monitoring system that allows them to find bad actors quickly.

New Data Sources

Knowledge is power in the AML fight, and bank employees need data to fight more effectively. AI solutions can also provide banks with troves of data that help banks and employees better understand how bad actors operate. Data from transaction monitoring solutions can highlight how criminals concealed their true natures, enabling banks to adjust their AML strategies accordingly. These insights can empower banks and people to continuously educate themselves on current and emerging money laundering patterns.

Mazur pointed out that banks can also collaborate more effectively and share their knowledge thanks to legislation such as 314(b) of the United State’s Patriot Act. Money launderers, he noted, can hide behind “plausible deniability” to hide their true intent from banks. The U.S. Patriot Act, however, enables banks to (legally) share their insights on a centralized platform and contribute to the industry’s collective knowledge. Globally this principle is also encouraged in the FATF Principles and new pending regulations.

The more insights that are gathered, the more effective banks and their employees around the world will be in understanding and stopping money launderers.

Key Takeaways

Dedicated people need the right tools to do their jobs as effectively as possible. Transaction monitoring solutions can help teams to quickly review millions of data points and identify dubious patterns, all from a centralized platform. Employees can further study this data to understand how money launderers are adjusting their habits and anticipate what they might do next. Supportive leadership helps their efforts by bringing their entire organization into the cause.

It takes everyday people committed to protecting banks from getting roped into criminal activities to stop money launderers in their tracks. The task might be challenging and even thankless, but real differences can be made when every bank employee believes they can make a real difference. Remember that the next time you count the number of milk options at the supermarket.

AML compliance programs are an ongoing process with regulations and sanctions lists constantly shifting. Watch our on-demand webinar Enhancing AML Programs with AI to learn now.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…