Case Study

Feedzai Boosts Legacy FraudSystems for Digital Banking Era

Case Study

$30M

in savings over three years

75%

average value detection rate for a 0.1% intervention rate

12:1

false positive

reduction

Company

A large North American retail bank serving over 17 million clients in 29 countries.

Industry

Retail Bank

Financial Services

In the digital age, relying solely on generic rules to prevent fraud can result in high costs and unsatisfied customers for any financial institution.

This was the case for a large North American retail bank, which was struggling to tackle a growing alert queue, low job satisfaction within its fraud team, and missed fraud cases. These issues hindered the bank’s ability to offer new products and payment channels to customers.

Feedzai was tasked with improving detection without entirely replacing the incumbent solution. Through a successful hybrid offering, Feedzai saved the bank $30 million over three years and dramatically reduced false positives.

Rules-Only Fraud System Isn’t Good Enough in Digital Banking

The existing rules-only system couldn’t keep up with the fast-paced digital world, leading to over 15,000 outstanding alerts and growing. The bank needed a real-time transaction fraud detection solution for all payment channels, as well as an established, knowledgeable, and proactive long-term partner.

Feedzai’s Transaction Fraud for Banks Provided Autonomy, Flexibility, and Speed

The bank chose Feedzai due to our expertise in adaptive machine learning-based fraud detection and our commitment to being a proactive, long-term partner focused on innovation and seamless integration with the bank’s existing systems.

Feedzai provided a modular solution by embedding its machine learning algorithms as an overlay to cover existing deficiencies, allowing the bank to retain control of autonomy, flexibility, and speed in creating, implementing, and reviewing its risk strategy at any given time.

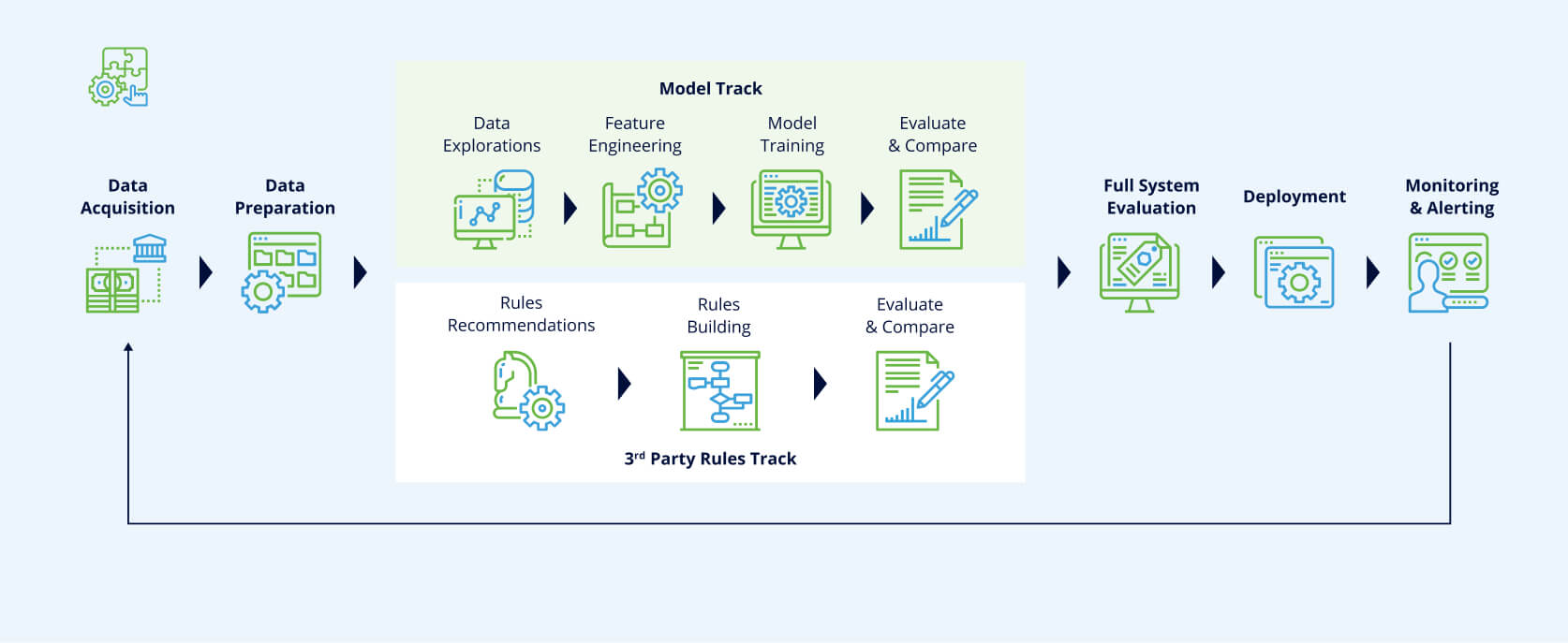

Implementing Machine Learning Algorithms Alongside Legacy Rules for Transaction Fraud

Feedzai specialists worked with the bank’s in-house team to integrate necessary transactional API calls with the Kafka streaming engine for analyzing historical and real-time data.

Next, we integrated alerts with the third-party case management tool, which included a feedback loop of fraud outcomes.

Feedzai also led an immersive two-week learning experience for the bank’s data science team to maximize results.

Machine Learning Ops Feedzai

Feedzai Boosts Legacy Retail Banking Fraud Prevention

Feedzai not only exceeded the bank’s expectations for preventing fraud losses, we also empowered the bank to do more with its own data and third-party data in a short amount of time. We also empowered the bank to do more with its own data and third-party data in a short amount of time. This successful project saved the bank $30 million in its first three years and is now driving the next phase to increase efficiency and drive down costs.

Sign up for our newsletter

Stay Up-to-Date on Financial Risk Management

We care about protecting your data. Here’s our Privacy Policy.