Is there anything more frustrating than learning important information too late? For financial institutions, realizing that a customer’s risk level has dramatically increased since their last periodic review is akin to not checking traffic conditions, leaving for a trip, and getting stuck in traffic. That’s why banks can’t afford to wait to respond to new developments. Feedzai’s perpetual KYC (pKYC) solution helps banks shift away from static, periodic review processes and embrace event-driven reviews instead.

The Top 3 Pain Points with Traditional KYC

Here are three critical problems with many existing KYC solutions that financial institutions currently use.

Legacy systems rely heavily on periodic reviews

Many banks use legacy KYC solutions that schedule a customer’s periodic KYC review based on the initial risk rating during onboarding. The problem with this approach is that the customer’s risk assessment is based on just a brief snapshot. If a customer looks like they pose a low risk, the onboarding bank may schedule their periodic KYC reviews yearly (or longer, depending on the bank’s internal policies). If their risk has increased substantially, banks may learn too late that their commercial relationship with the customer poses a high risk. What’s more, these periodic reviews are predictable and easy for criminals to navigate. Bad actors who achieve a low-risk rating at the point of onboarding, can become a customer, move money, and evade detection for a long time.

Manual review processes are not sustainable

Even if banks wanted to take a proactive approach to KYC/CDD, the review process is time-consuming for risk and compliance analysts. The financial institution’s analysts must constantly monitor if the customer’s name appears on any watchlists, moves to a riskier geographic region, or takes on a high-risk occupation (e.g., casino manager or arms trader). Analysts would have to perform these reviews for hundreds of thousands of customers – possibly more. What’s more, they have to check numerous data sources. It’s both highly labor intensive and, at the end of the day, unsustainable. Even more concerning, especially for banks with limited resources, is that not every alert is productive. Some systems are quite rigid in their rules and generate alerts for minor changes in risk scores. Consequently, analysts spend time working on an alert, only to learn that the customer moved from their current address to a new one 10 miles away.

Onboarding delays create bad customer experiences

At the same time, banks can’t afford to create a negative onboarding experience for their trustworthy customers. Recent research from McKinsey found 40% of a customer’s onboarding time is focused on KYC due diligence and account opening. Some banks identified that onboarding problems are responsible for a 56% rate of banking customer abandonment. Banks want to be sure to treat their “good” customers right. If a trustworthy customer experiences a long delay in their vetting process, they’ll ultimately develop a negative viewpoint of the bank. Some customers may even abandon the onboarding process before it’s completed.

Feedzai’s pKYC Solution In Action

Feedzai’s perpetual KYC solution enables banks to build a more holistic, evolving view of customer risk. The solution enables banks to shift to ongoing due diligence by automatically updating customer information and using trigger-based reviews instead of periodic ones. This approach allows banks to allocate resources more effectively to the highest-priority alerts.

So what does this mean in practice? Banks that use pKYC can quickly minimize their risk exposure by learning how a customer’s shift in risk affects the organization. Banks can also reduce the burden on their analyst teams by allowing them to focus their efforts on high-priority alerts.

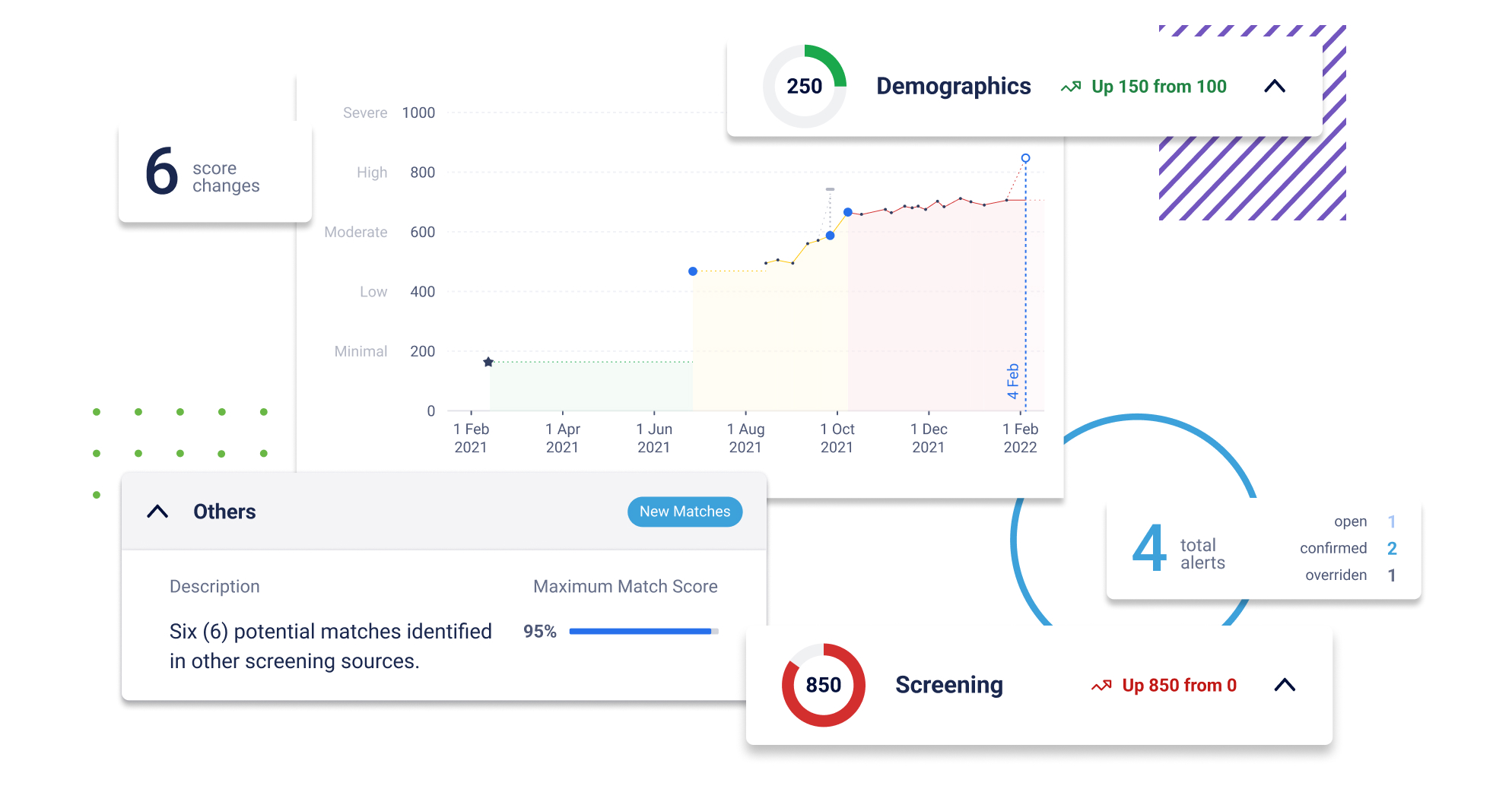

Analysts see for themselves how significantly a customer’s risk level has changed in a given period. The customer risk timeline below tracks a customer’s evolution over a year (February 2021 to February 2022). During that time, their risk score jumped significantly from 200 to 850.

The Feedzai pKYC solution also outlines where the most significant changes in risk occurred. The customer’s demographics experienced a 150-point increase. But the most important change is related to Customer Screening. Six score changes occurred starting in October 2021 pushing them into the high-risk category. Analysts can see straightforward explanations of what triggered these alerts and determine how to handle the customer based on their findings.

Banks can’t afford to let these kinds of shifts go undetected. Feedzai’s pKYC solution allows banks to proactively identify risks before the next scheduled review.

The 4 Pillars of Feedzai’s pKYC Solution

Our pKYC solution continuously monitors how customer profiles evolve. The solution analyzes a customer’s risk based on four main vectors:

- Demographic Data: Checks a customer’s name, date of birth, address, nationality, and other information about the customer for notable changes.

- Customer Screening: Screens the customer’s name against watchlists daily, including politically exposed persons (PEPs), Office of Foreign Assets Control (OFAC), and adverse media.

- Operational Patterns: Alerts the FI if the customer is the subject of or connected to a suspicious activity report (SAR) and other data that impacts the customer’s risk score.

- Transactional Patterns: Provides a breakdown of how the customer’s transactional patterns have evolved, including the frequency of payments and the geographic regions where the customer sent money over a specific time.

The combination of these four risk vectors creates a continuous, comprehensive view of how customer risk levels have evolved. Feedzai’s pKYC solution dynamically displays significant changes in customer profiles. Once these changes are detected, it triggers an alert that enables banks to embrace event-based alerts.

We also understand that not all banks view risk the same way. Banks can customize their score thresholds and adjust them to their risk tolerance and resource levels. This means your team isn’t burdened with unproductive alerts.

Customer patterns shift quickly. In an age where information moves rapidly, banks need the ability to respond to new developments quickly instead of waiting months or longer to learn how a customer’s risk level has evolved. Embracing event-triggered reviews, rather than relying on periodic reviews, keeps banks ahead of new risk threats.

Share this article:

Tiffany Ha

Tiffany Ha is a Sr. Product Marketing Manager at Feedzai. She has spent the last eight years in the fraud and financial crime prevention space. Financial crime trends and tactics are always evolving, so the accompanying technology must stay ahead of the curve. She loves connecting the dots between technology and market challenges to help financial institutions achieve their goals.

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…