Scam Prevention for Banks

Comprehensive. Responsive. Proven.

The only solution that natively captures all scam signals

Brands Trust Feedzai

Stop Scams with Feedzai

Awards and Recognition

The Proven Solution to Combat Scams

Proud partners

Market Challenges

Stop Scams. Build Trust.

Protect Revenue.

56%

of customers have been the victim of a financial scam

77%

of customers say they will leave their bank if they do not get a refund for a scam

79%

of customers aged 25-44 will leave their bank if it blocks a legitimate transaction

Source: The Human Impact of Fraud and Financial Crime on Customer Trust in Banks.

Trust in Every Touch

Recreate the In-Branch Experience

for Digital Interactions

Customer Risk 360

Analyze each individual’s unique banking behavior to more accurately identify signs of duress and coercion

Proactive Prevention

Utilize a combination of scam-specific machine learning models and rules to stop scams sooner

Tailored Customer Journeys

Minimize friction, tailor operational treatment for scam victims, and educate customers

How it Works

Protect Your Customers from Scams

A proven platform to reduce losses and customer impact

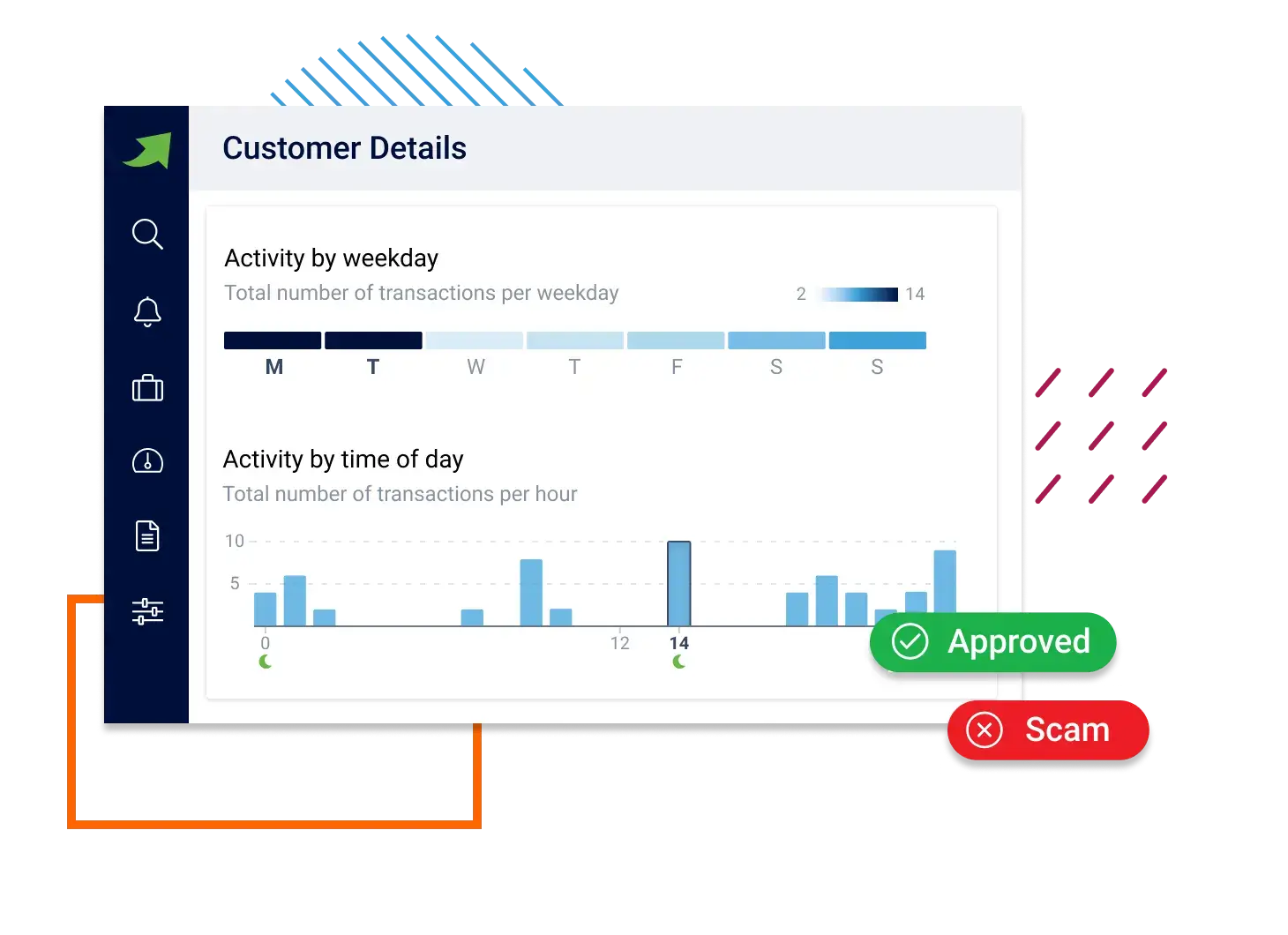

Customer-Centric Risk Analysis

Maintain a 360 view of customer risk to continually verify if a user is acting as normal or showing signs indicative of coercion or manipulation.

Behavioral Biometrics and Transaction Patterns

Unlike other solutions, ScamPrevent natively analyzes customers’ multi-channel transactional activity, digital signals, and behavior over time using scam-specific machine learning models.

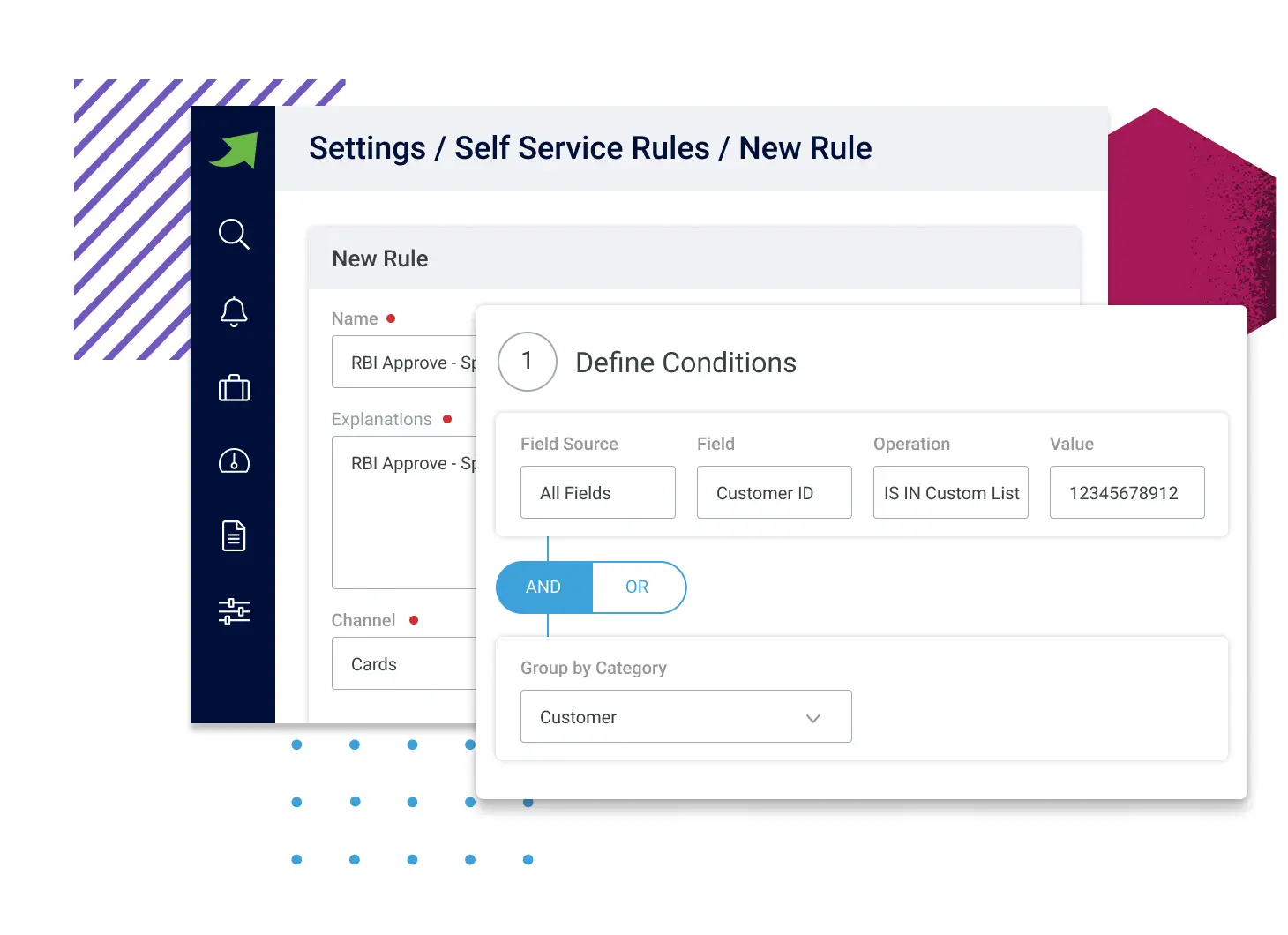

Self-Service and Explainability

Customize score thresholds and workflows to optimize decisions that trigger scam-specific alert workflows. Get clear explanations for triage teams to contact customers with understanding and empathy.