Feedzai Fraud Detection for Corporate Banks

Onboard Businesses Safely

A single platform for mastering risk across all channels, geographies and payment types. Build trust to help businesses become confident in adapting to the ever-changing financial crime landscape.

Single Platform - Single-minded Ambition

Monitor Risk Appropriately Across Products and Services

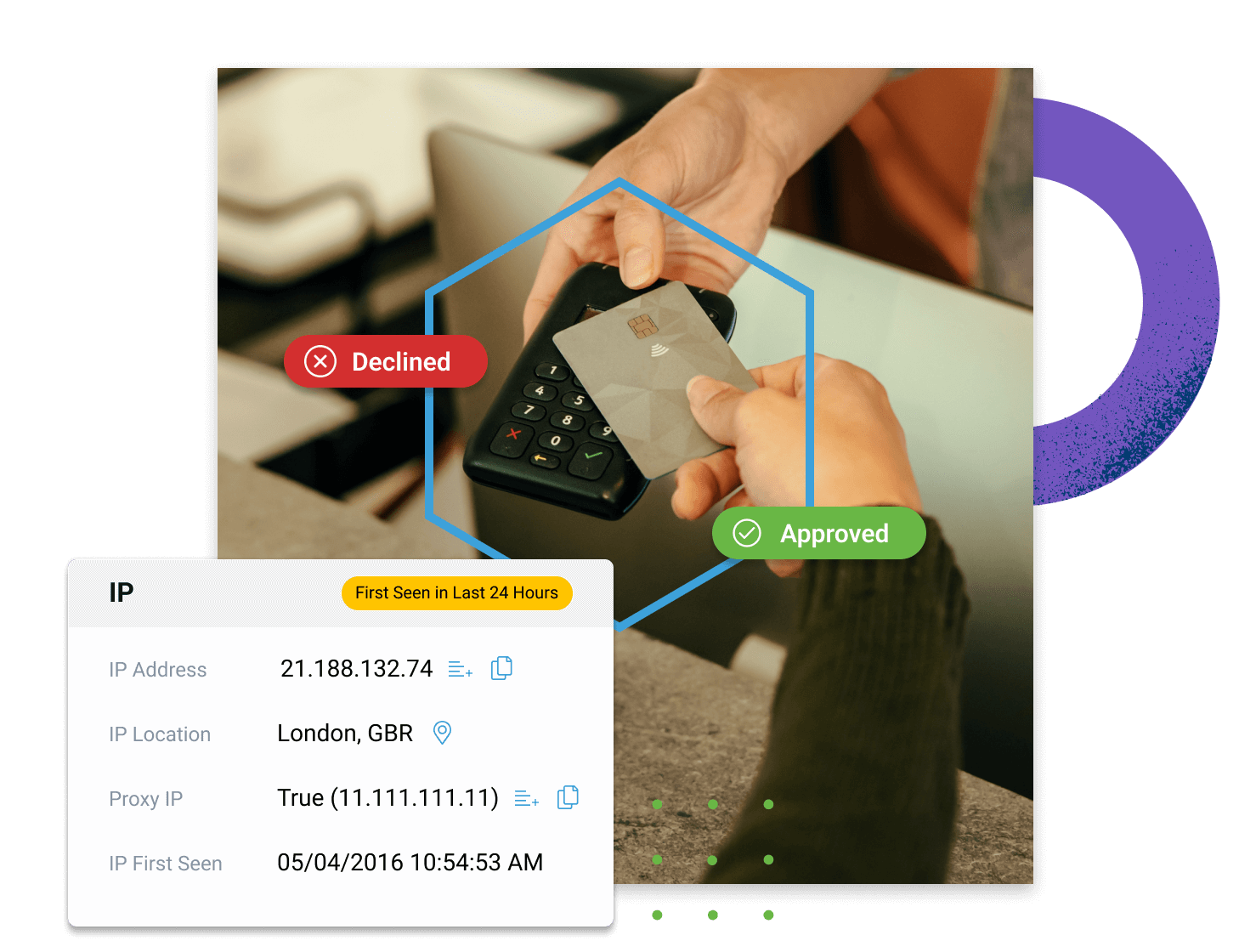

Fight Fraud at Speed and Scale

Benefit from a continuously updated picture of payment activity by combining long-term & real-time data, network attributes and more in order to more precisely identify known and evolving fraud typologies.

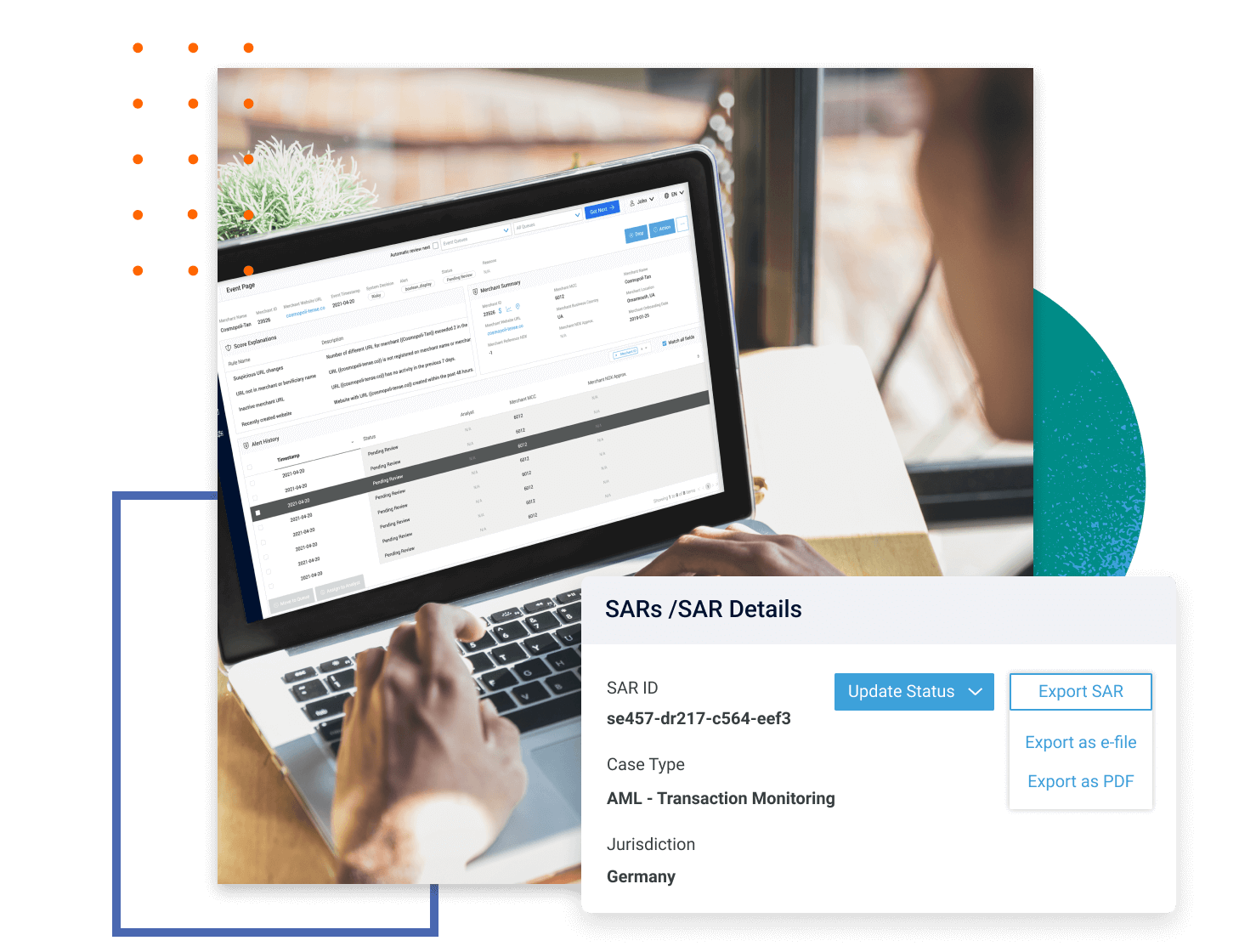

Adaptive AMLRisk Management

Bad actors use businesses to target banks for cleansing dirty money. Monitor money movement across the entire customer base to ensure funds are not used for illicit purposes. Integrated SAR filing auto-populates fields for submission – reducing manual inputs and streamlining the process.

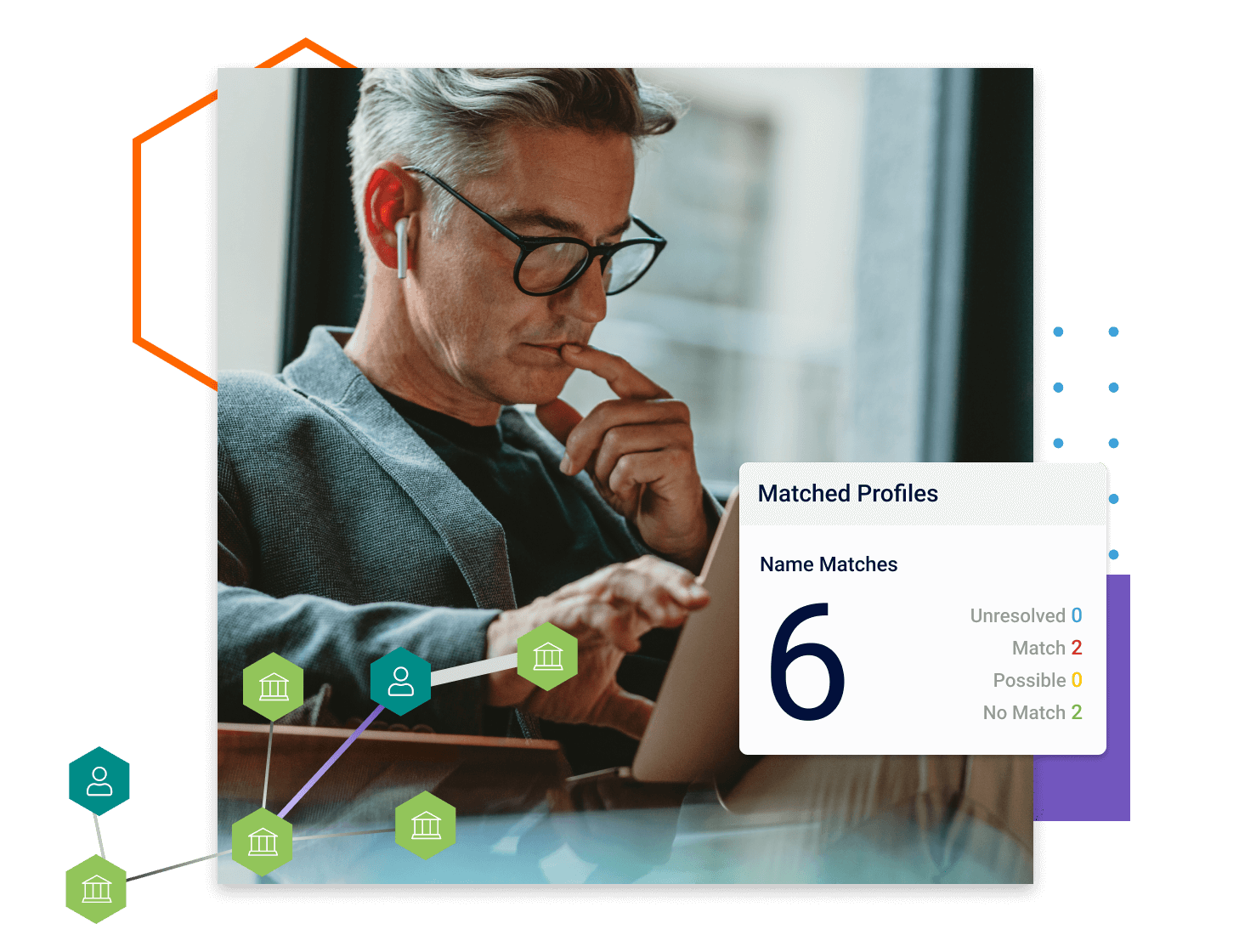

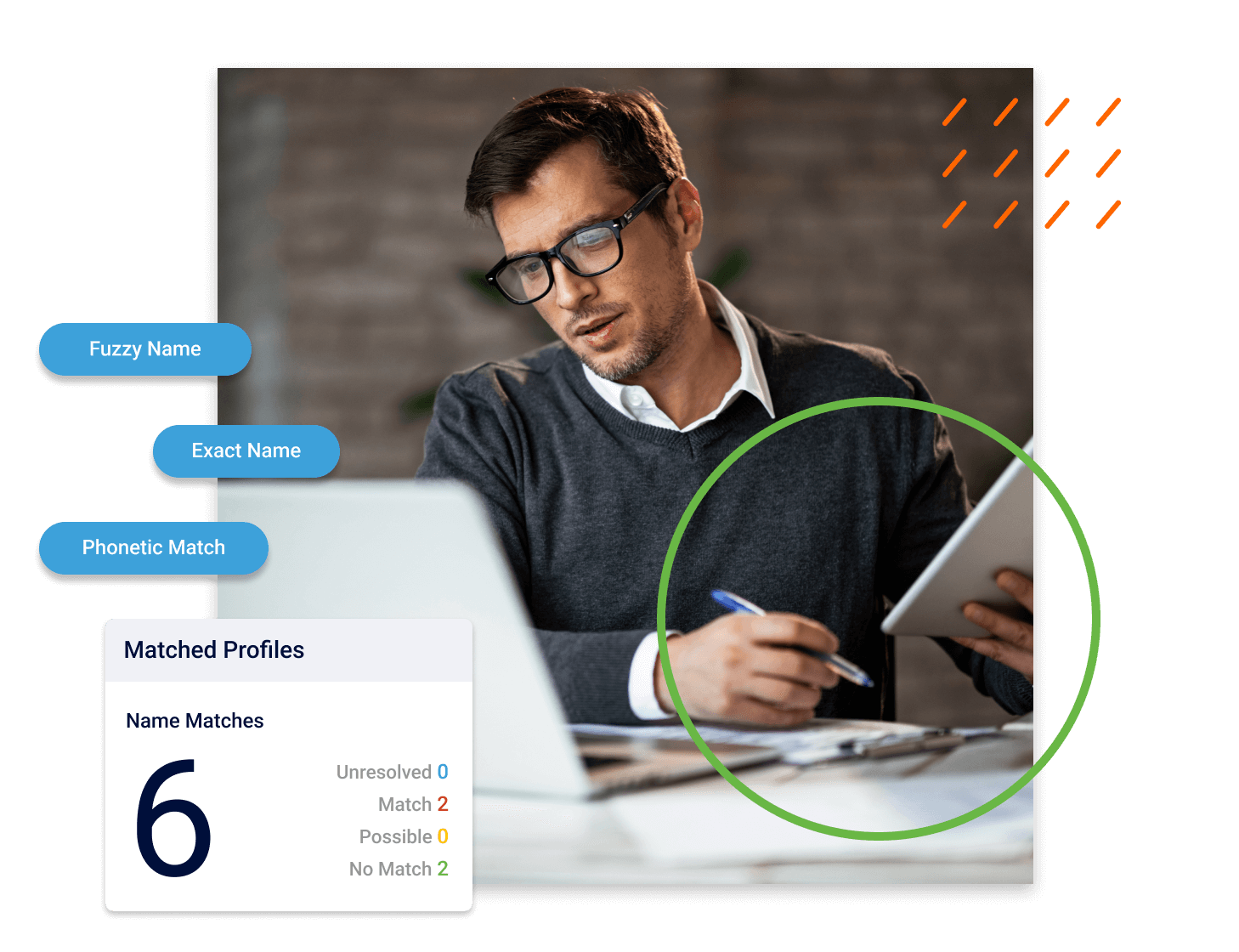

Automated Watchlists.Effortless Compliance.

Check legal entities, their owners and controllers during onboarding and then dynamically to proactively uncover matches. Reduce false positives using our fuzzy match algorithm, which correctly distinguishes close matches and name variations.

RiskOps Studio

Self-service FinCrimePrevention

A single, standard architecture that supports all business units, users, customers and products in one place.

Flexibility to choose data sources for faster, fairer, individualized decision-making.

Feedzai Solutions

Streamline The FinCrimePrevention Journey

Ready to use end-to-end risk monitoring.

Receive all the essentials for success with our packaged risk solutions for Fraud, AML, Compliance, PEP and Sanctions Screening and Digital Trust.