Feedzai Fraud Prevention for Retail Banks

Maximize Financial Opportunities

A single platform for mastering risk across all channels, geographies and payment types. Exceed customer expectations for trust, safety, and fairness across the end-to-end customer lifecycle.

Build for Retail Banks

Safeguard Every Stepin the Customer Journey

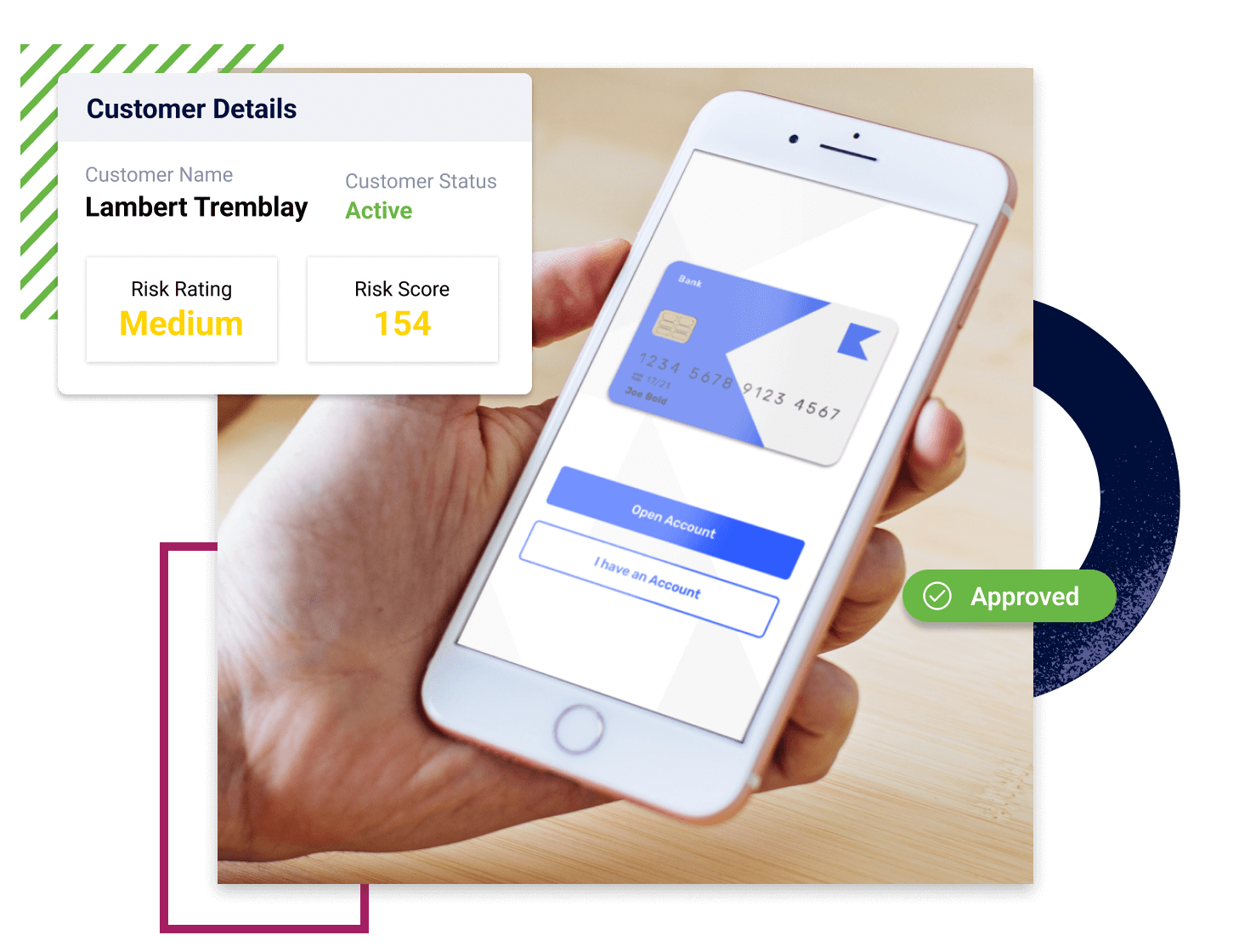

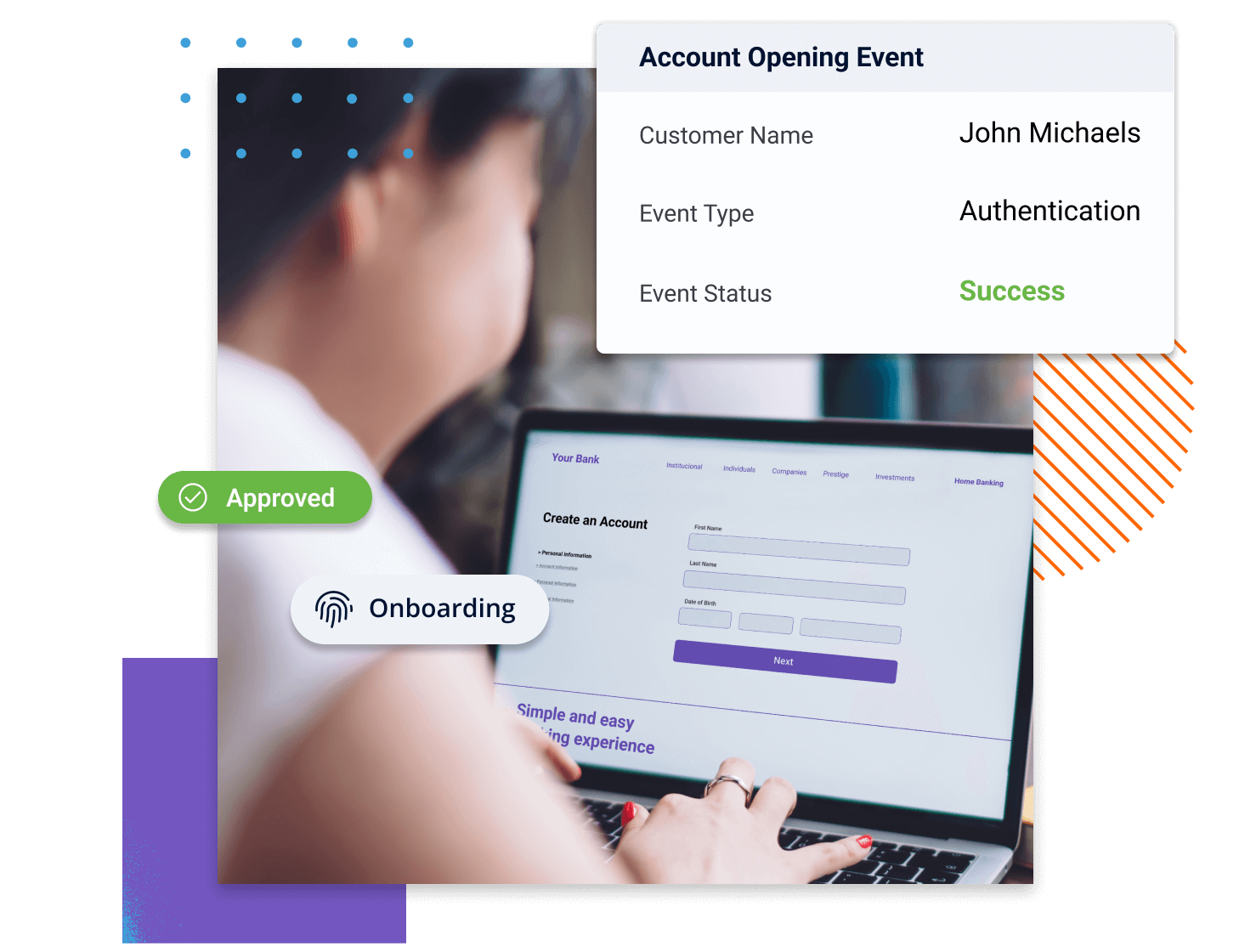

FrictionlessAccount Opening

Increase customer acquisition by automating account opening processes. Leverage credit, social media, email, and digital attributes to assess applicant risk.

Know Your Customer(KYC/CDD)

Combine diverse data sources, watchlists, and adverse media to assess customer risk during onboarding and continually throughout the customer lifecycle. Comply with regulatory requirements while keeping illicit actors out and good customers happy by treating them fairly and as individuals.

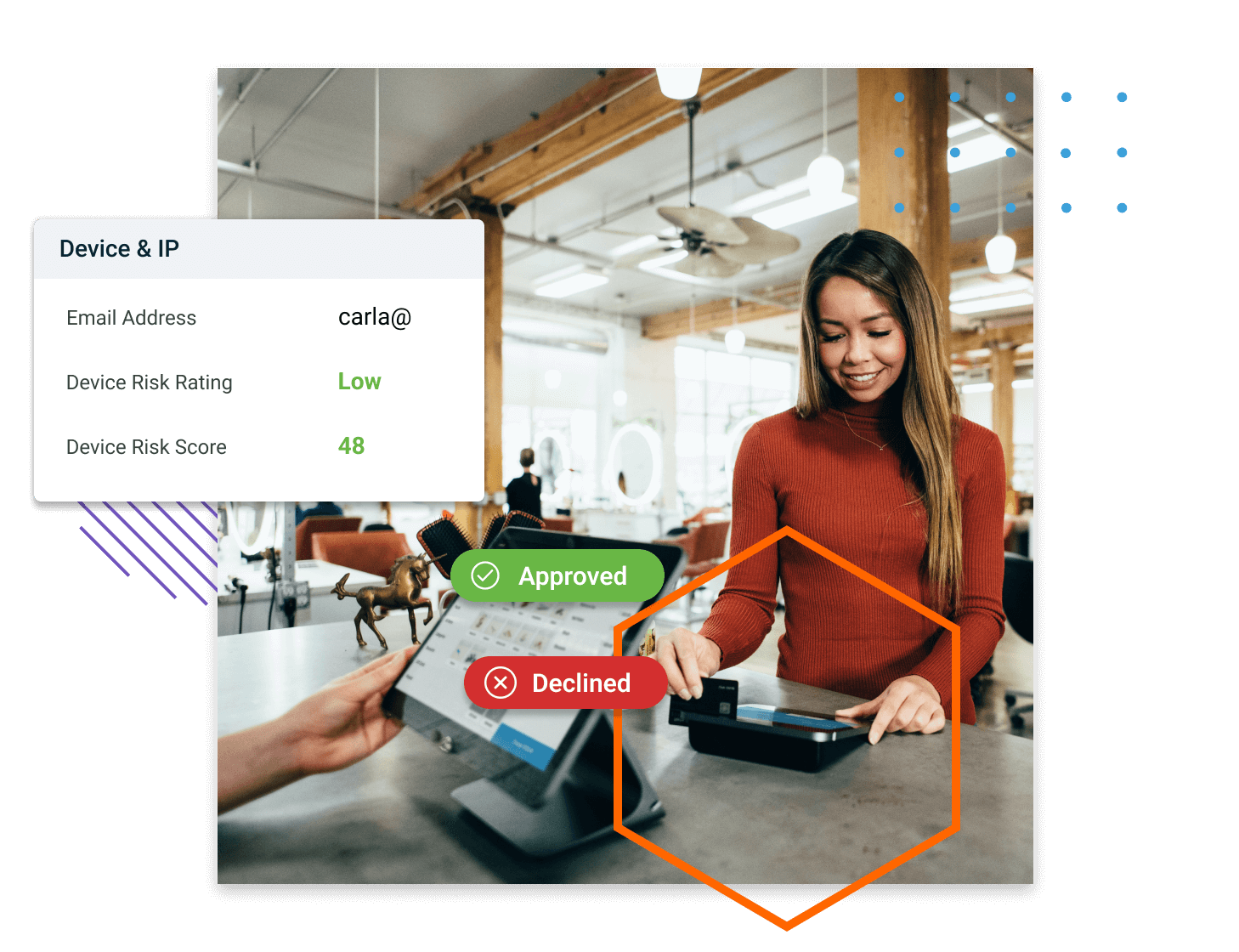

Fight Fraud at Speed and Scale

Benefit from a continuously updated picture of payment activity by combining long-term & real-time data, behavioral biometrics, device, network attributes, and more in order to precisely identify known and evolving fraud typologies.

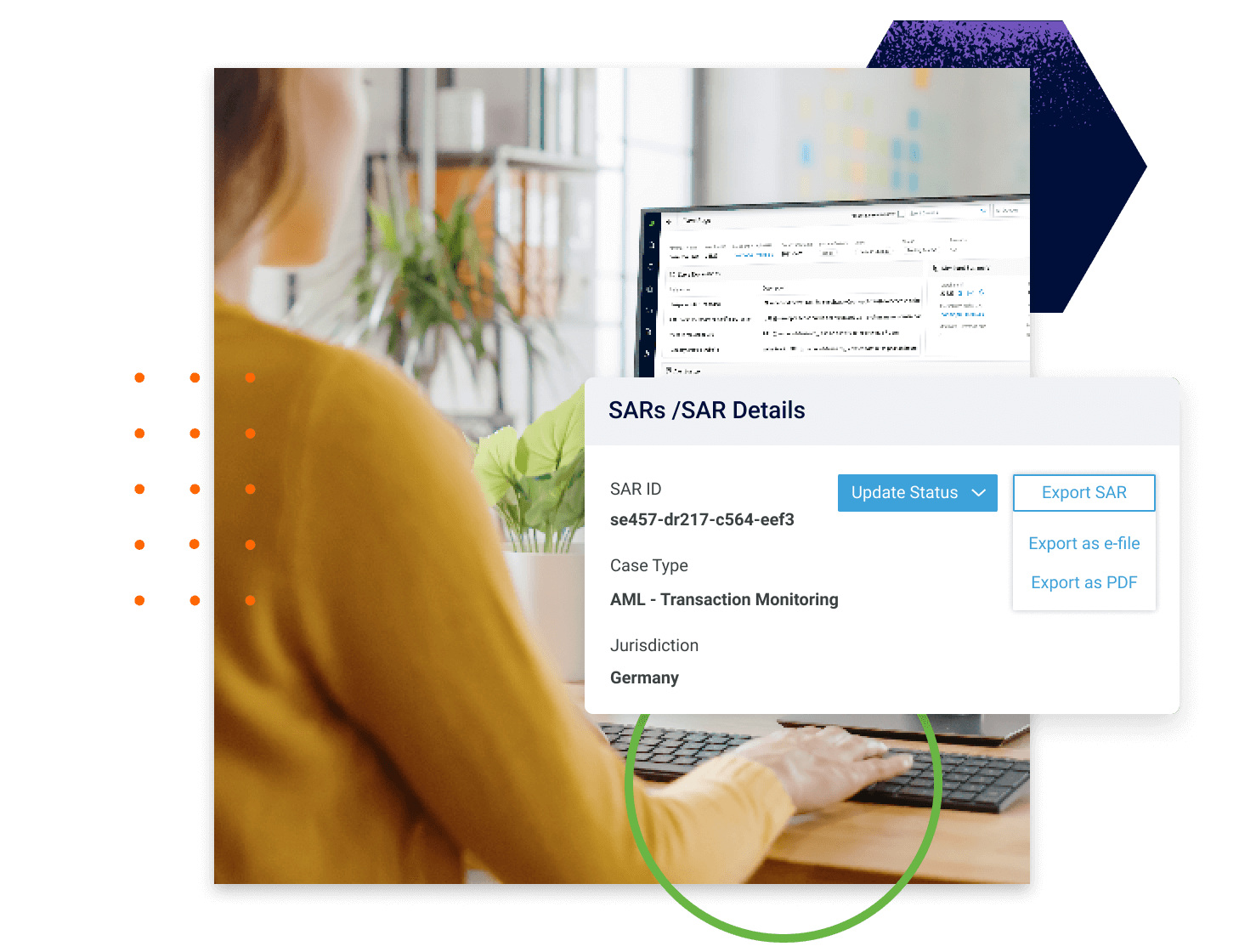

Adaptive AML Risk Management

Monitor money movements across the entire customer base to ensure funds are not used for illicit purposes. Integrated SAR filing auto-populates fields for submission – reducing manual inputs and streamlining the process.

Digital Trust

Looking for a complete online fraud prevention solution?

Stop fraud before it happens. Continuously authenticate unseen elements behind every interaction with Feedzai’s unique 3 in 1 device, malware and behavior proactive defense.

RiskOps Studio

Self-service FinCrimePrevention

A single, standard architecture that supports all business units, users, customers and products in one place.

Flexibility to choose data sources for faster, fairer, individualized decision-making.

Feedzai Solutions

Streamline The FinCrimePrevention Journey

Ready to use end-to-end risk monitoring.

Receive all the essentials for success with our packaged risk solutions for Fraud, AML, Compliance, PEP and Sanctions Screening and Digital Trust.