Transaction Fraud Detection

Omnichannel.Precise.Fair.

Accelerate the transition to more effective fraud prevention and customer confidence across multiple channels and payment types.

Brands Trust Feedzai

Why Choose Feedzai

Protect customers at each interaction

and at every transaction

Safeguard Financial Lives

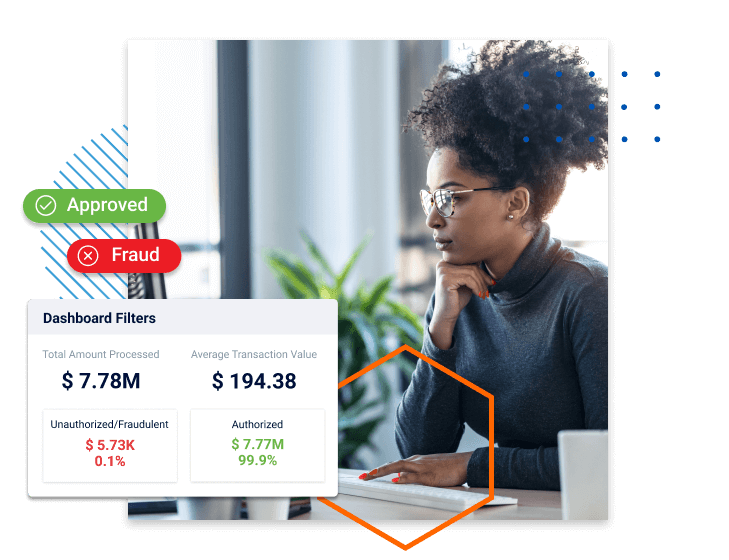

Utilize real-time customer interaction and transaction data to increase accuracy and enhance CX ensuring silent, intelligent, and frictionless protection.

Precise Control

Risk scoring based on behavioral and transactional patterns that continuously learn over time. Adjust parameters and thresholds seamlessly to align with business risk appetite.

Omnichannel Protection

Rapidly adjust fraud countermeasures with rules, & machine learning models that can leverage data across all channels and geographies.

Feedzai by the Numbers

Results at a

Leading Bank

$310B

Processed annually

>12M

Transactions scored in real-time every day

<10ms

Average latency (in milliseconds)

Feedzai Offerings

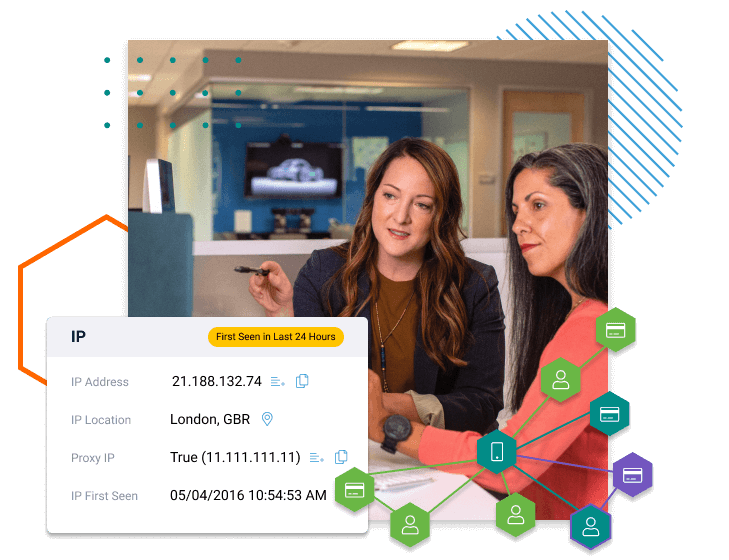

Easily Identify Fraudsters

Powerful technology to keep your customers safe from fraud

Omnichannel Fraud

Prevention

Feedzai Transaction Fraud for Banks delivers a secure and frictionless banking experience from login to transaction by detecting and preventing fraud in real time.

- Single omnichannel platform

- Detect and prevent fraud across the customer journey

- Continuously learning behavioral and transactional pattern-scoring models to keep in front of emerging fraud

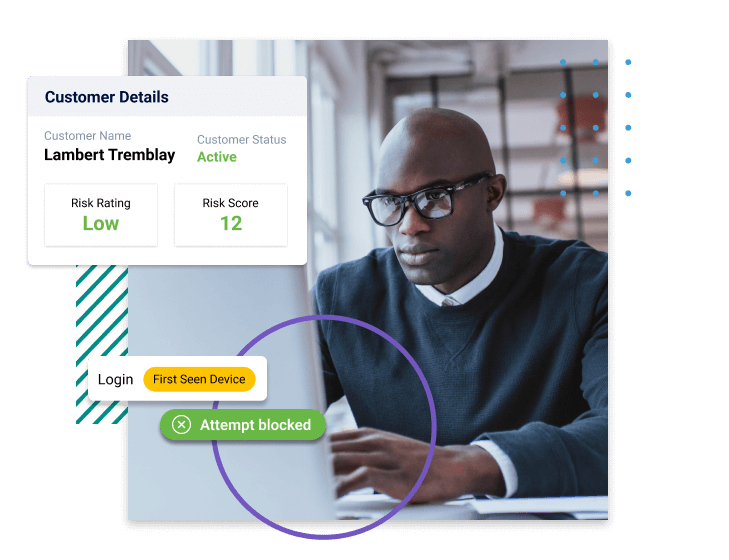

Prevent ATO Fraud from

Reaching the Transaction Stage

Protect customers across every interaction by silently detecting and preventing fraud before it happens. Leverage Device, Network, Malware & Behavioral Biometrics to stop:

- Malicious logins or payments

- Credential-stealing attacks

- Manipulation and impersonation attacks

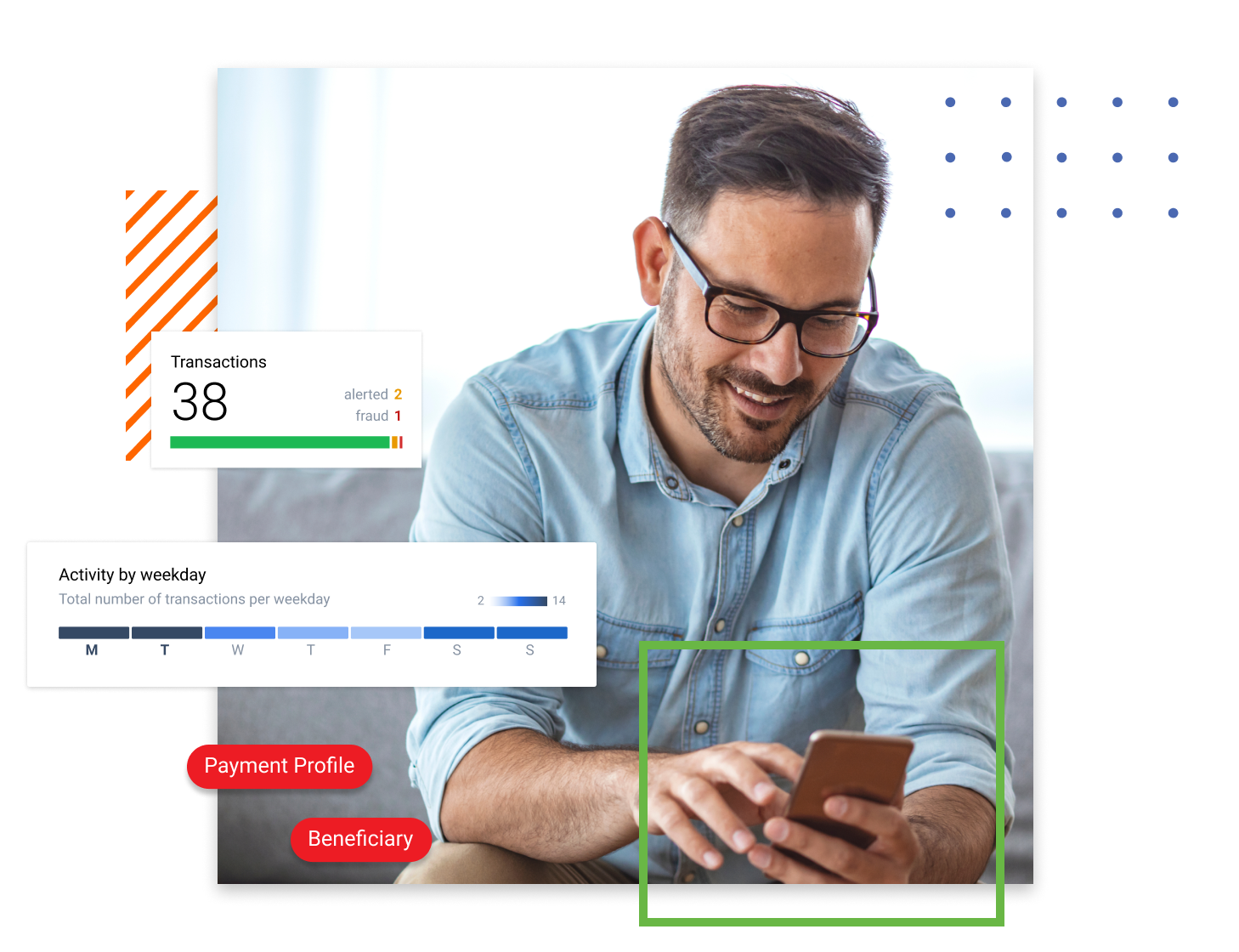

Scam Prevention

Understand customer interactions at a granular level across all channels to detect behavioral changes associated with scams and authorized push payment (APP) fraud.

- Single platform to detect behavioral anomalies

- Machine learning capabilities augmented by rules to drive the best outcomes

- Accurately flag suspicious activity

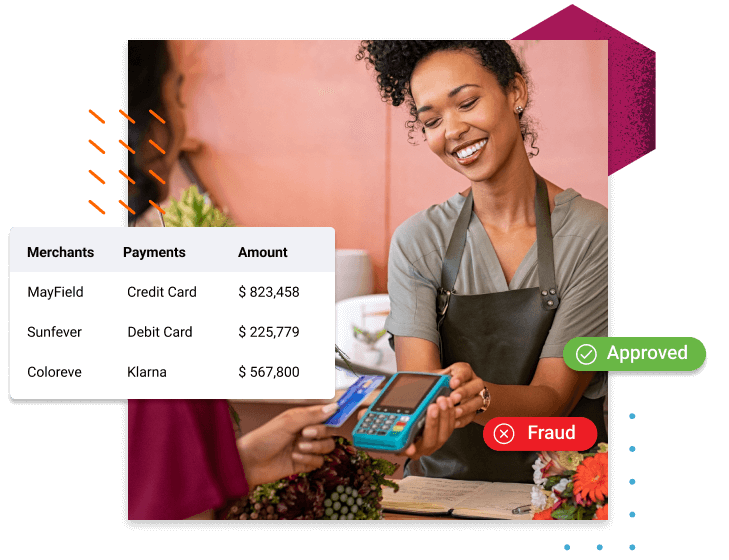

Transaction Fraud and Merchant Monitoring for Acquirers & PSPs

Protect both your merchants and yourself from fraud across all payment channels.

- Instantly approve or decline transactions with confidence using our out-of-the-box fraud and risk strategies

- Train and deploy new ML models in days, not weeks

- Monetize our multi-tenancy environment to generate additional revenue streams

Merchant Monitoring

360º view of merchants, allowing you to spot compliance, credit, and scheme risks instantly.

- Reduce financial and reputational damage from high-risk merchants using predefined risk strategies

- Speedy and confident decisioning via a comprehensive alert investigations suite

- Create a competitive advantage by pre-funding merchants with confidence.