Money laundering. Fueled by mobster movies and international espionage thrillers, the phrase has a mysterious, exciting edge to it. But as is often the case, the truth is far less appealing than the glitzy Hollywood version.

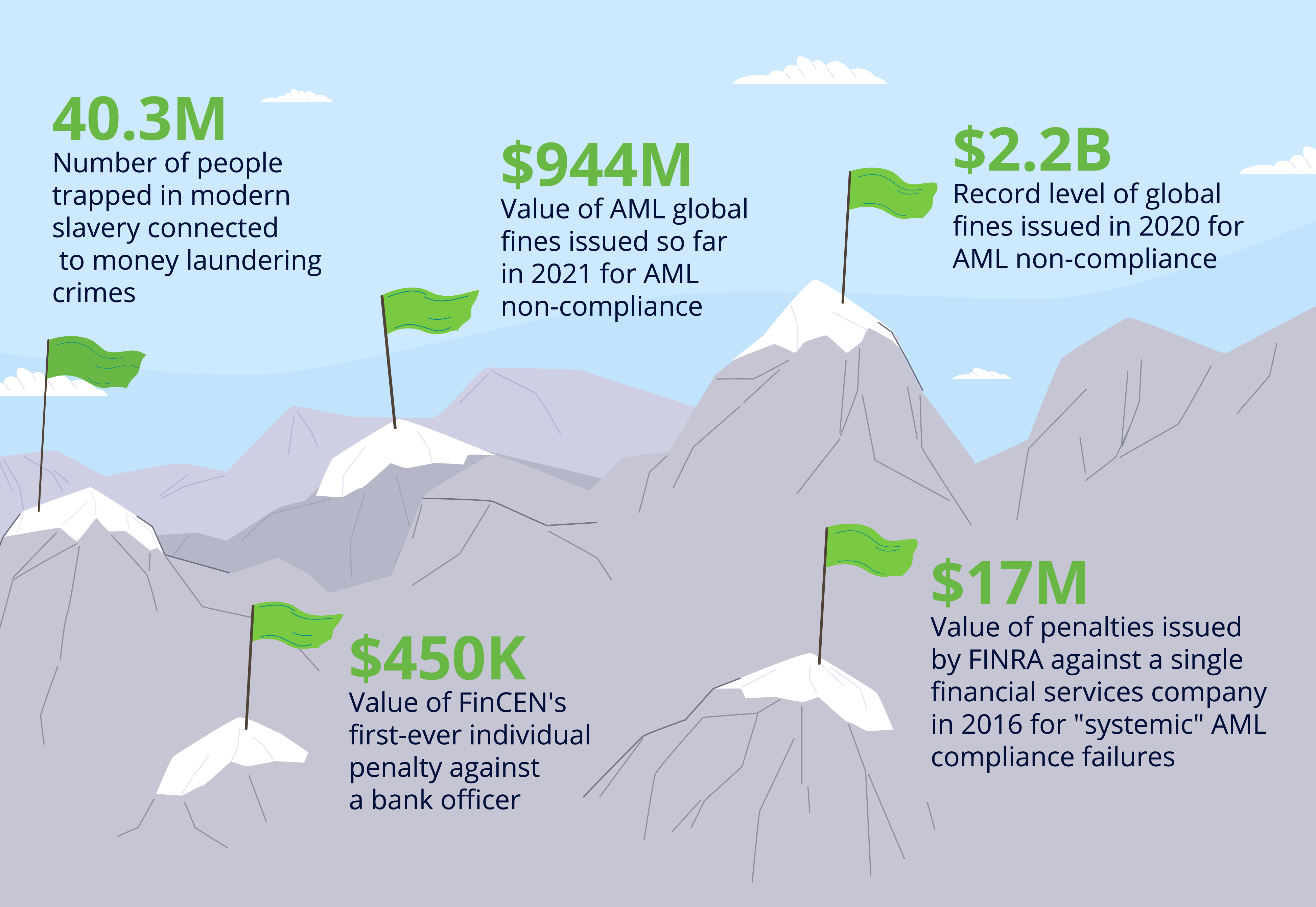

In reality, money laundering is an activity that traps 40.3 million people in modern slavery, fuels political unrest, and finances terrorism across the globe. There are real-world consequences.

As money laundering crime grows more sophisticated, AML regulations must keep pace. These regulations have honorable and important intentions, but there’s no denying the ever-evolving compliance headaches they create for financial institutions (FIs).

FIs must develop powerful AML programs, lest they face the financial fines, increased regulatory scrutiny, and reputational damage of an AML program gone wrong.

The Repercussions of an AML Program Gone Wrong

What could your firm do with over $2 billion? That’s the estimated amount of fines global regulators are estimated to impose on financial institutions once all is said and done in 2021. This figure indicates that the record level of $2.2 billion in fines issued in 2020 could be broken later this year.

But it’s not just the firms that are penalized for AML non-compliance. Last year, FinCEN issued its first-ever penalty on an individual bank officer valued at $450,000 for failure to prevent AML violations. The message to bank executives was clear: turning a blind eye or simply failing to stop criminal activity opens the door for severe personal liability.

But fines are just one form of penalty for non-compliance. There’s also the increased scrutiny imposed by regulators along with additional hoops firms must jump through.

With so much at stake, what steps can your firm take to help fight money laundering, protect your leaders, and avoid paying fines?

5 Steps to Avoid AML Fines and Regulator Scrutiny

1. Create ‘YOUR’ AML program, not ‘AN’ AML program.

No two businesses are alike. This is especially true for firms responsible for high-stakes securities trades and high-value money transfers. That’s why it’s critical that your organization design its own, specific AML program applicable to your unique business model, operations, and risks.

A generic AML program does not address your firm’s business complexity, geographical diversity, variety of customers, a suite of products and services, and the different risks they pose. All these factors must be considered as a baseline to create an effective and compliant AML program specific to your firm’s operations, needs, and realities. Risk assessments are crucial.

You’ll also want to ensure your AML solution is flexible. For example, some out-of-the-box solutions do not allow data scientists to create ad hoc code. Or the solutions aren’t easily adjusted based on factors that are important to you, such as reporting periods. The risk of a rigid solution is that you must wait, sometimes for months, for the solution provider to make adjustments for you. Changes — even subtle ones — may often be costly.

And this brings us to the next crucial feature.

2. Select a Robust AML Solution.

The importance of this can’t be stressed enough. AML solution capabilities directly correlate with its success.

What should FIs look for in an AML solution? There are numerous characteristics to ensure robustness. Here are some key requirements:

Apply Artificial Intelligence (AI) and Machine Learning (ML). AI is the future of AML. In fact, even the regulators encourage this. AI allows AML programs to evolve and scale. Financial crime is continuously evolving, particularly in our digital world. Your business is growing and changing as well. If both crime and your firm change, your AML platform can’t remain static; it must also be able to evolve and scale.

Be data agnostic. One of FINRA’s key findings of firms that failed to establish proper AML programs? Data gaps. If the data feeding your AML program has gaps or is inaccurate, your AML program will most likely fail, possibly resulting in fines and besmirching your reputation.

Look for a solution that integrates data from multiple sources to mitigate the risk of data gaps. This is critical as data is typically scattered across multiple systems, and firms struggle with data silos. By aggregating, analyzing, and correlating data correctly and efficiently in a single platform, FIs can solve one of the toughest problems in compliance with anti-money laundering regulations.

Monitor transactions. A proper AML solution should have an advanced and robust transaction monitoring system. It’s the cornerstone of an effective AML compliance program. Your AML solution should be able to score transactions for credit, debit, ATM, and prepaid cards (and digital wallets) for card-present and card-not-present payments. It should also be able to score automated clearing house (ACH), wire, and peer-to-peer transactions.

Know Your Customer (KYC) and Customer Due Diligence (CDD). Your AML solution should either contain this function or be able to integrate with third-party systems to ensure new accounts, existing customers, and beneficiaries are free from money laundering activity and are not on terrorist, criminal, or other blocked persons watchlists. This must be a continuous process.

3. Schedule internal control reviews and reassessments.

FINRA levied a $17 million penalty on a financial services company for, among other reasons, “systemic” problems with its AML compliance program during a period of rapid growth. Remember, your AML compliance is not a set it and forget program.

For example, a large European bank failed to reassess its AML programs following a 2007 merger, resulting in over €200 billion in money laundering and an ensuing criminal investigation by U.S. authorities. Shares in the bank lost a third of their value.

Regulations require regular internal control reviews and reassessments. The best way to make sure this happens is to schedule these in advance on a quarterly or bi-annual basis. They should be essential, non-moveable processes in your AML compliance program.

4. Write it right.

You can’t have a compliant AML program without documented policies and procedures. The reasons for this are twofold.

First, writing out your policies and procedures provides a prime opportunity to think through each step of your program and gain a thorough understanding of what all the steps are, the resources you’ll need, and the requirements you’ve covered.

Second, and more importantly, the AML Act of 2020, Bank Secrecy Act (BSA), EU Fourth Anti-Money Laundering Directive, FINRA Rule 3310, and US Patriot Act all require firms to implement a written program that is approved, in writing, by a senior manager.

Essentially, Rule 3310 establishes the minimum requirements for your AML policy and requires you to:

- Create policies and procedures that are effective. Your policies should lead to the detection and reporting of money laundering activities. Comply with the Bank Secrecy Act.

- Include independent testing for compliance.

- Testing must occur on an annual basis if it is conducted by individuals who work directly with customer accounts.

- Testing must occur every two years if it is conducted by individuals who do not execute customer transactions or hold customer accounts.

- Designate an AML compliance officer who is responsible for implementing AML policies, procedures, daily operational monitoring, and internal controls.

5. Build an Efficient AML team.

In addition to designating a compliance officer, you must define the compliance officer’s duties, provide him or her with proper resources, and build an efficient AML team.

A basic AML program ensures each team member:

- has clearly defined roles and responsibilities have complete knowledge of AML policies and procedures

- is provided with a comprehensive onboarding plan

- receives ongoing education and training

An Efficient AML Team

Efficient AML teams have all the attributes of a basic team, but they also have access to a risk platform that utilizes both a rules-based engine and an AI engine. This increases efficiency because it significantly lowers false-positive rates, and your team won’t spend thousands of hours a year investigating false positives. Instead, they’ll have the tools regulators are looking for — and they’ll be equipped to fight money laundering criminals.

Anti-money laundering compliance. It’s a phrase that might not garner the same intrigue as a spy thriller, but it does help fight issues like human trafficking, terrorism, drugs, and fraud. And while your AML Compliance Officer doesn’t ski down the Swiss Alps, exchanging gunfire with sinister villains after having just imbibed a shaken martini, lives actually do hang in the balance of a job well done or an opportunity lost. That’s no small responsibility. Perhaps you should start calling your AML Compliance Officer…Bond, James Bond. Though 007 sounds good too.

Share this article:

Related Posts

0 Comments5 Minutes

Spotlight on Denmark: Fraud and Financial Crime Insights from ‘Den sorte svane’

The recent documentary mini-series "Den sorte svane" has sent shockwaves through Danish…

0 Comments9 Minutes

Enhancing AML Transparency with Smarter Data

Doesn’t it seem like new financial threats crop up in the blink of an eye? That’s why…

0 Comments10 Minutes

Enhancing Anti-money Laundering Systems Architecture

A speaker at a financial crime conference I recently attended summed up the problem with…